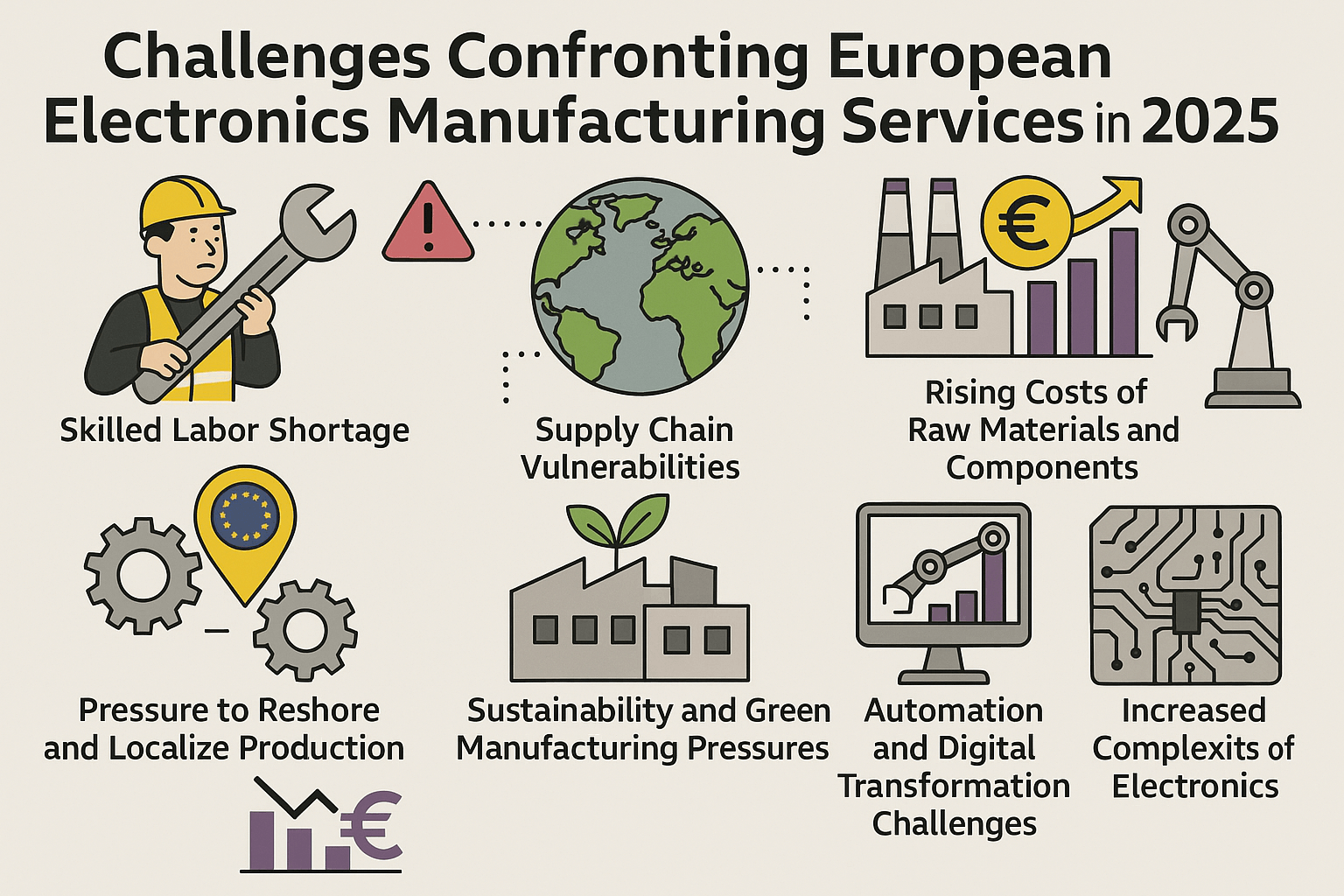

In 2025, the European Electronics Manufacturing Services (EMS) sector faces major technological, economic, and geopolitical challenges. Original equipment manufacturers (OEMs) must update their strategies and adapt quickly to stay competitive. Companies are prioritising supply chain resilience, quality control, and intellectual property protection amidst rising labour costs, talent shortages, and increasingly complex regulations, which often involves switching to European manufacturing.

This analysis explores the top seven challenges confronting the European EMS industry, which include supply chain vulnerabilities, environmental regulations, and emerging market dynamics.

1. Geopolitics and Trade Wars

The global electronics industry is undergoing a fundamental restructuring as geopolitical tensions are fragmenting once-interconnected supply chains into regional ecosystems.

Countries are increasingly prioritising technological independence, with major powers reshaping international trade through strategic interventions. Thus, the United States’ aggressive restrictions on semiconductor exports to China indicate a shift from open global markets to controlled, politically driven trade policies. Meanwhile, conflicts such as the war in Ukraine and tensions over Taiwan, the world’s most advanced chip manufacturer, further destabilise global supply networks.

In response, European manufacturers are accelerating reshoring efforts to reduce dependency on geopolitically sensitive regions and build more resilient, localised supply chains. To remain competitive, EMS companies have to adapt to complex trade restrictions, foster strategic partnerships within Europe, and safeguard critical technological capabilities.

2. Supply Chain Disruptions

The European electronics manufacturing sector faces significant supply chain vulnerabilities, particularly in sourcing critical components like printed circuit boards (PCBs).

Europe’s share of global PCB production has plummeted from 15-20% in 2000 to just 2.6% in 2023, with China now controlling 58.7% of the market. This dependence on Asia increases the risk of supply disruptions and security threats, as seen during crises like Covid-19 and ongoing geopolitical tensions. With 60% of PCBs used in European military products sourced from outside Europe, the risk of intellectual property theft and sabotage is real.

To address this, manufacturers must diversify suppliers, invest in local sourcing, and push for a Europe-wide mandate to ensure PCBs for critical sectors are sourced domestically or from allied nations.

3. Digitalisation of Internal Processes

With rising labour costs in Europe, EMS companies should consider implementing advanced automation and AI-driven process optimisation to streamline workflows and reduce administrative burdens. By cutting indirect and redundant expenses, European contract manufacturers can maintain competitive pricing in the global market.

Digital transformation is no longer optional. It is essential for improving efficiency and strengthening cost structures. Additionally, increased digitalisation can enhance brand image, positioning companies as agile leaders in their industry.

4. Sustainability and Sustainable Energy Sources

Today, embracing sustainability is not just an environmental obligation. It is a strategic investment that can drive long-term business growth.

The ever-evolving regulatory mandates and growing public expectations mean European EMS companies must prioritise sustainability to meet both environmental requirements and consumer demand for greener practices.

With higher energy costs in Europe compared to other regions, using renewable energy and optimising energy use are key to staying competitive. Sustainable practices not only help with compliance but also improve a company’s reputation, leading to long-term savings through better efficiency and lower carbon emissions.

5. Uncertain Demand and Economic Volatility

As trade tensions continue and European economies like Germany face stagnating GDP, demand for industrial goods, including electronics, remains unpredictable. The EU struggles with low innovation, high energy costs, and increasing sustainability demands, impacting its industrial competitiveness.

Mario Draghi’s report calls for urgent economic reforms, highlighting the need for strategic investments of €750-800 billion annually to address Europe’s slow growth and investment gaps, particularly in sectors like green technologies.

For EMS companies, agility is crucial. Adapting to market trends, investing in flexible manufacturing, and embracing innovation will help maintain competitiveness. Swift action from both policymakers and businesses is needed to ensure sustainable growth and Europe’s global position.

6. Talent Acquisition and Retention

The EMS industry is struggling with a shortage of skilled workers, especially in production operations. This issue is becoming more urgent as countries like Germany face around 700,000 unfilled positions, despite a generally weak economy. With low unemployment levels across the EU, the competition for talent is intensifying, making it harder for companies to find and retain skilled workers.

To tackle the talent gap, companies must invest in workforce training, especially as reshoring brings production back to the EU and US. Training will bridge the gap and foster a culture of innovation. A supportive work environment boosts employee satisfaction, leading to higher productivity, better quality, and enhanced competitiveness in a fast-changing market.

7. Regulatory Compliance and Evolving Standards – Path Towards Deregulation

The European manufacturing sector faces challenges from evolving regulations, including environmental, product safety, and labour standards, which add administrative costs and slow production. For EMS companies, maintaining compliance can generate expenses, reduce agility and competitiveness.

Industry leaders, including those at the World Economic Forum, have urged the EU to speed up deregulation to remain globally competitive, especially as the U.S. rapidly rolls back regulations. Stricter EU rules hinder innovation, particularly in AI and tech, limiting Europe’s global manufacturing position.

Final Thoughts

From geopolitical tensions to talent shortages, European EMS providers have to address a number of critical challenges, affecting their productivity and competitiveness in 2025. Reshoring and local sourcing have become essential for enhancing business resilience, while advanced digitalisation, automation, AI adoption, and sustainable practices offer long-term growth opportunities.

As individual businesses seek effective solutions to mitigate risks, embracing deregulation in Europe can lower compliance costs, streamline operations, and improve market responsiveness.

To learn more, visit https://asselems.com/