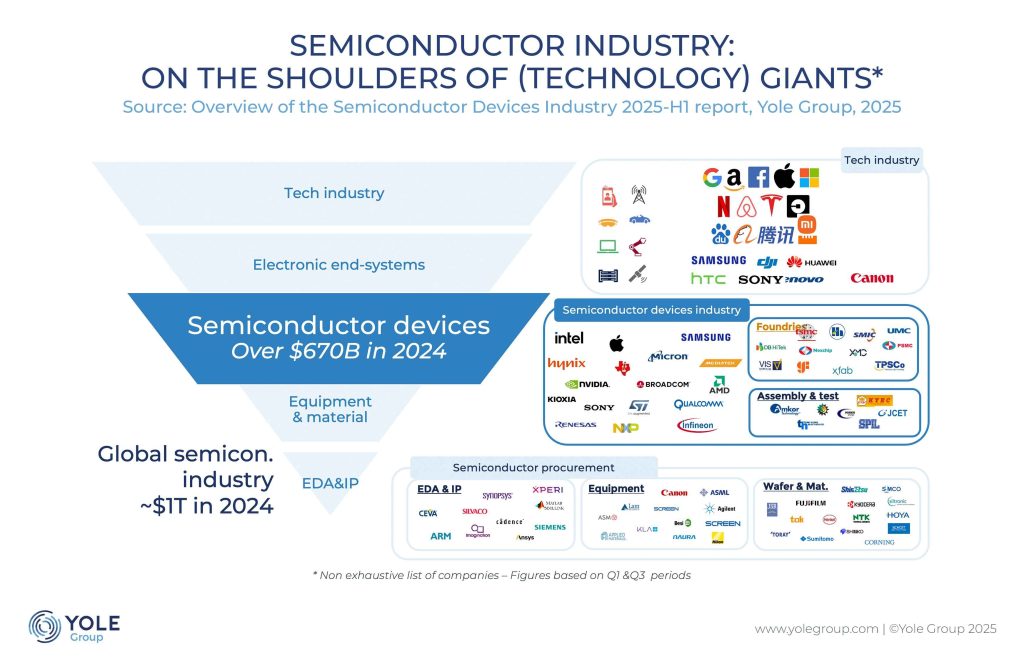

At over $670 billion in 2024, Yole Group’s analysts report a $100 billion year-over-year increase from 2023. And this is just the beginning—strong growth is expected in the coming years, fueled by the generative AI boom.

In the latest market & technology report, Overview of the Semiconductor Devices Industry H1 2025, Yole Group analyzes each semiconductor segment and highlights significant growth rates exceeding 10% for servers and automotive applications. Servers, in particular, are set for robust growth, and the market will be worth $390 billion by 2030. While the automotive sector boasts a higher growth rate than the server market, its total value will reach $112 billion.

In the latest market & technology report, Overview of the Semiconductor Devices Industry H1 2025, Yole Group analyzes each semiconductor segment and highlights significant growth rates exceeding 10% for servers and automotive applications. Servers, in particular, are set for robust growth, and the market will be worth $390 billion by 2030. While the automotive sector boasts a higher growth rate than the server market, its total value will reach $112 billion.

Yole Group’s analysts also emphasize the computing market’s active role over the next five years, with a 6% growth rate expected to push it to $150 billion by 2030.

From a component standpoint, DRAM, NAND, and processors will drive the semiconductor devices industry, maintaining a steady growth rate of 7 to 8% through 2030. Yole Group conducts daily analyses of semiconductor innovations through a specialized suite of products. With Teardown Tracks and Reverse Engineering & Costing Reports, the group examines the manufacturing processes, technical decisions, and strategies of the leading semiconductor companies. Through these insights, Yole Group provides a comprehensive view of the semiconductor devices industry, now presented in its latest report: Overview of the Semiconductor Devices Industry H1 2025.

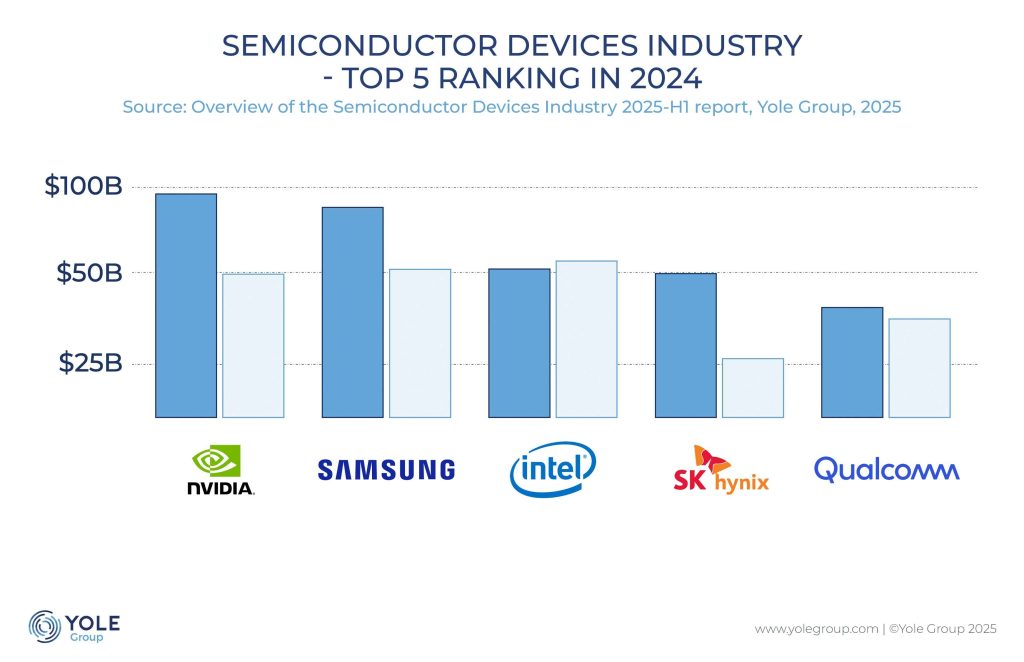

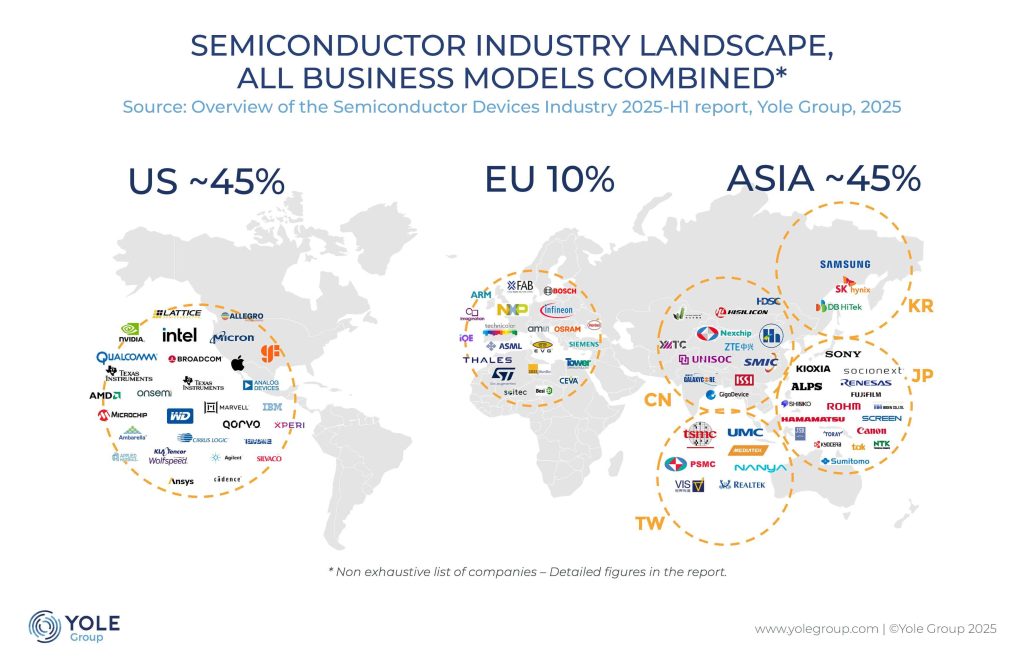

Behind those impressive market figures, giants are playing in the playground. “The 35 largest semiconductor companies represented 80% of the industry in 2024,” asserts Pierre Cambou from Yole Group. “Famous names are there redefining the industry. “

NVIDIA, a fabless semiconductor company, now leads the industry with $96 billion in semiconductor device revenue in 2024. Following closely is TSMC, a Taiwanese open foundry, with $87 billion in wafer foundry revenue for the same year. Samsung, based in South Korea and primarily an IDM(1), secures the third position with $83 billion in revenue in 2024. Intel, also an IDM, ranks fourth with $52 billion in revenue in 2024. Together, these four largest companies account for nearly a third of the entire semiconductor industry, encompassing all business models.

The other semiconductor companies, part of the top 35, have revenues ranging 20-fold, from roughly $5 billion to $100 billion. About 40% of these are not semiconductor device companies but open foundries, OSAT(2) companies, equipment companies, or materials companies.

Yole Group is a leading market research and strategic consulting firm specializing in the semiconductor industry. Through their in-depth investigations, analysts provide valuable insights into market trends, emerging technologies, and competitive dynamics. Their expertise helps businesses navigate the rapidly evolving semiconductor landscape, driving innovation and strategic decision-making. With a strong focus on semiconductor manufacturing and equipment, advanced packaging, memory, computing, power electronics, and more, Yole Group continues to be a trusted third party in the industry.

Stay tuned on Yole Group’s website and follow us on LinkedIn.

Acronyms

(1) IDM: Integrated Devices Manufacturer

(2) OSAT: Outsourced Assembly and Test