As microelectronics underpin the rise of artificial intelligence and high-performance computing, the smallest manufacturing imperfections have become billion-euro problems. Each defect at the sub-micron scale can derail an entire batch of chips or displays. Paris-based deep-tech company Hummink is tackling that challenge head-on.

The company has raised €15 million in a funding round co-led by KBC Focus Fund, Cap Horn and Bpifrance to expand deployment of its patented High-Precision Capillary Printing (HPCaP) technology, which enables manufacturers to print metals and functional materials with record-level accuracy and repair microscopic defects in real time.

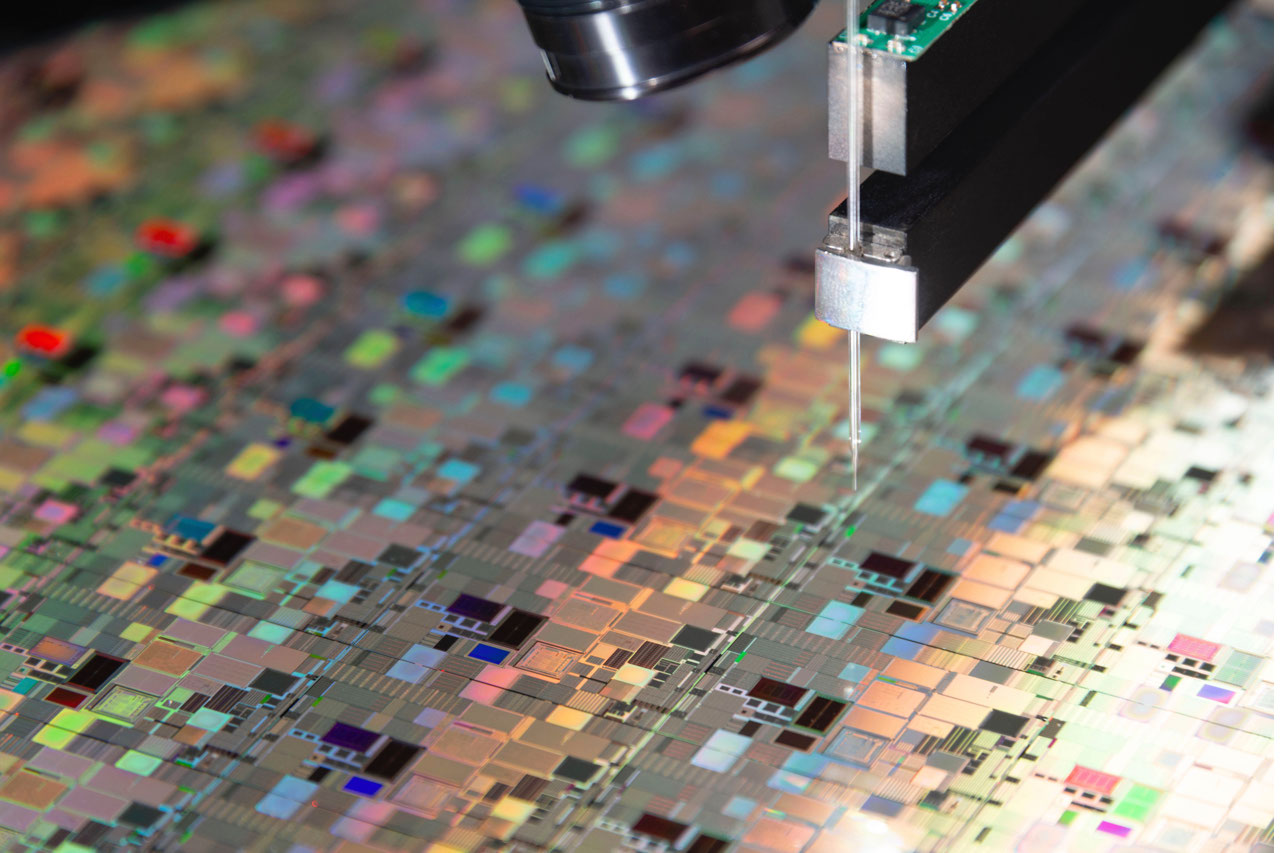

Founded in 2020 as a spin-off from the École Normale Supérieure – PSL and the CNRS, Hummink was created by materials scientist Amin M’Barki and hardware startup operator Pascal Boncenne. Its technology works like the world’s smallest fountain pen, writing at the nanoscopic level with a controlled flow of material. The process allows manufacturers to build and correct circuitry directly at the sub-micron scale, opening new frontiers for semiconductor packaging, next-generation memory, and advanced displays.

Traditional lithography remains the workhorse of electronics production, but even the best processes generate flaws that lead to yield losses and material waste. In comparison, Hummink’s printing tools act as surgical instruments at the micronic level, complementing lithography by identifying and correcting those flaws. The result is higher output, lower scrap rates, and reduced environmental impact across the industry.

“Our mission is to bring precision where it has never been possible before,” said Amin M’Barki, Co-Founder and CEO of Hummink. “Microelectronics is at the heart of the AI revolution, and every micron matters”.

“With HPCaP, we give manufacturers a practical way to improve yields, cut waste, and make advanced technologies more sustainable.” adds Pascal Boncenne, co-founder and COO.

Hummink’s first integration use case focuses on next-generation OLED displays for smartphones and laptops, where up to 30 percent of production is discarded each year due to microscopic defects – representing around €16 billion in losses and enough wasted material to cover 6,000 football fields. The company’s technology can correct most of these defects, helping manufacturers recover output that would otherwise be lost. Revenue today comes from sales of Hummink’s NAZCA demonstrator, a first-generation printing machine designed for R&D labs. NAZCA brings Hummink’s high-precision printing technology to research environments, helping democratize access to sub-micron fabrication and repair. The company also produces tailor-made conductive inks.

Hummink’s NAZCA systems are already installed in laboratories and research centers across Europe, Asia, and the United States, including Duke University, where researchers recently used the technology to produce the first fully recyclable, sub-micrometer printed electronics published in Nature Electronics. The company is now under qualification with major display manufacturers in Asia whose factories discard large portions of production due to microscopic flaws. Early tests suggest Hummink’s solution could boost yields by around 10 percent.

With a team across the United States, Taiwan, Japan, and South Korea, Hummink expects to double its workforce by 2026 and double its revenue by year-end, driven by strong demand for its printing modules and proprietary conductive inks. The latest funding round, supported by historical investors Elaia Partners, Sensinnovat and Beeyond, was joined by the French Tech Seed fund managed on behalf of the French government by Bpifrance as part of France 2030, Cap Horn and KBC Focus Fund, bringing extensive semiconductor know-how, and backed by the European Innovation Council Fund, recognizing the strategic importance of Hummink’s technology. It will accelerate the development of Hummink’s industrial printing module and prepare the technology for full integration inside semiconductor and display fabs.

As the complexity of chips and displays continues to climb, the industry’s success will depend on technologies that can operate at the same scale as the challenges they face. Hummink’s vision is to embed its sub-micron printing process directly within manufacturing lines worldwide, transforming how the smallest details in advanced electronics are produced and repaired for years to come.

Nuno Carvalho, Investment Director at KBC Focus Fund commented: “Hummink stands out as an exceptional deeptech company that bridges academic excellence with industrial relevance. Their High-Precision Capillary Printing (HPCaP) technology is not only a breakthrough in nanofabrication—it’s a game-changer for defect repair in OLED and semiconductor manufacturing, where sub-5 micron precision is critical and unmet. We’re proud to support Hummink’s journey from lab to fab, and believe their scalable business model and strong team position them to become a key enabler of next-generation electronics manufacturing.”

“Yield improvement is becoming one of the most critical levers in advanced manufacturing,” said Francois Charbonnier, Investment Director at Bpifrance. “Hummink’s combination of precision, speed, and scalability makes it a foundational technology for the next generation of microelectronics.”

“Breakthroughs like Hummink’s redefine what’s possible in manufacturing,” said Flora Coppolani, Partner at CapHorn. “Their ink-based nanoprinting platform unlocks a new paradigm of control and scalability, bridging the gap between research and industrial scale ,a true cornerstone for the next wave of deeptech innovation.”

About Hummink

Founded in 2020, Hummink was founded by materials scientist Amin M’Barki and hardware startup operator Pascal Boncenne. Its technology works like the world’s smallest fountain pen, writing at the nanoscopic level with a controlled flow of material. The process allows manufacturers to build and correct circuitry directly at the sub-micron scale, opening new frontiers for semiconductor packaging, next-generation memory, and advanced displays. https://hummink.com/real-time-microscopic-repair-the-next-breakthrough-in-semiconductor-yield/

About KBC Focus Fund

The KBC Focus Fund is a €50 million venture capital fund dedicated to investing in advanced technology (“Deeptech”) companies with international ambitions. Our primary goal is to accelerate emerging sectors such as nanotechnology, microelectronics, and the Industrial Internet-of-Things (IIoT). We do this not only by providing capital, but also by leveraging our extensive experience in venture investing and our strong industry network. The fund primarily targets opportunities in Belgium and neighboring countries, home to renowned centers of expertise in these technological domains.

About EIC Fund

The European Innovation Council Fund from the European Commission is a deep tech investor across all technologies. The EIC Fund aims to fill a critical financing gap, to support companies in the development and commercialisation of disruptive technologies. With its large network of capital providers and strategic partners it shares risk and crowds in market players.

About Elaia

Elaia is a European full stack tech and deep tech investor. We partner with ambitious entrepreneurs from inception to leadership, helping them navigate the future and the unknown. For over twenty years, we have combined deep scientific and technological expertise with decades of operational experience to back those building tomorrow. Our joint venture with Lazard, Lazard Elaia Capital, enables us to support exceptional founders at any stage. From our offices in Paris, Barcelona and Tel Aviv, we have been active partners with over 100 startups including Criteo, Mirakl, Shift Technology, AQEMIA and Alice & Bob.

About Cap Horn

CapHorn is a European venture capital firm and a growth partner to entrepreneurs transforming industry, technology, and the environment. As a hands-on investor, CapHorn supports innovative companies operating at the intersection of digital and industry—from ClimateTech to DeepTech, including Industrial AI and infrastructure technologies. Based in Paris, CapHorn invests from Seed to Series B rounds, alongside leading European and international funds, and provides founders with access to a dynamic ecosystem of private investors, industrial executives, and corporate partners. Since its inception, CapHorn has backed more than 60 startups, including nPlan, Wandercraft, Ledger, Agriodor, and Naboo, helping to foster a new generation of European technology leaders.

About Sensinnovat

Sensinnovat is the Belgium-based investment group of Rudi De Winter and Françoise Chombar, co-founders of the publicly traded semiconductor companies Melexis and X-FAB. Its portfolio spans listed equities, private equity funds and direct investments. Building on its roots in semiconductor, the direct investments focus on semiconductor-based technologies across diverse applications.

About Bpifrance and the French Tech Seed fund

Bpifrance finances companies at every stage of their development through loans, guarantees, and equity investments. Bpifrance supports them in their innovation projects and international expansion. It also ensures their export activity through a wide range of products. Advice, university programs, networking, and acceleration programs for startups, SMEs, and intermediate-sized enterprises are also part of the services offered to entrepreneurs.

Thanks to Bpifrance and its 50 regional offices, entrepreneurs have access to a close, unique, and efficient contact to help them meet their challenges.

Endowed with 500 million euros, the French Tech Seed Fund aims to support fundraising efforts of startups and innovative small businesses less than 3 years old that are developing highly technology-intensive innovations. As part of the “Programme d’investissements d’avenir” (PIA), now part of France 2030, and operated on behalf of the French government by Bpifrance and operated by Bpifrance, the fund relies on certified business contributors who are responsible for identifying and qualifying these young companies and connecting them with private investors. These business contributors, guarantors of the project’s technological validity, enable public investment in the form of Convertible Bonds up to 400 million euros, in addition to capital provided by private investors. Moreover, an additional 100 million euros are dedicated to equity investments beyond the conversion of Convertible Bonds.

About Beeyond

Beeyond is a consulting firm specialized in disruptive innovation, accompanying established companies and startups from concept creation through to market launch and fundraising. Operating across multiple industries including medical devices, pharmaceuticals, telecom, and consumer goods, Beeyond guides clients through out-of-the-core growth strategies, new business model development, prototyping, and partnership formation. As an early-stage investor, Beeyond combines strategic consulting expertise with venture capital support with focus on high-impact innovations with rapid returns and sustainable growth potential. Beeyond is a historical investor of Hummink and strong believer in Hummink’s potential to disrupt its target markets.