Award-winning embedded electronics consultancy, ByteSnap Design, has revealed the impact of COVID-19 and top strategies to survive adopted by UK companies during the pandemic in its new electronics industry survey report: Thriving in the Face of Change.

To develop the report, ByteSnap surveyed electronics sector personnel across a range of industries including automotive, industrial, MedTech and aerospace in April/May 2021.

ByteSnap Director Dunstan Power, said: “Over a year into the coronavirus pandemic, we decided to survey UK electronics professionals to gain an insight into the state of the sector, the challenges they have overcome and how their businesses have changed as a result of COVID-19. It is hugely encouraging when we look at the figures, how the majority of electronics companies have weathered the COVID-19 storm, particularly those who have adapted and used their indispensable expertise in the manufacture of essential medical equipment and component supply to help in the fight to protect lives.”

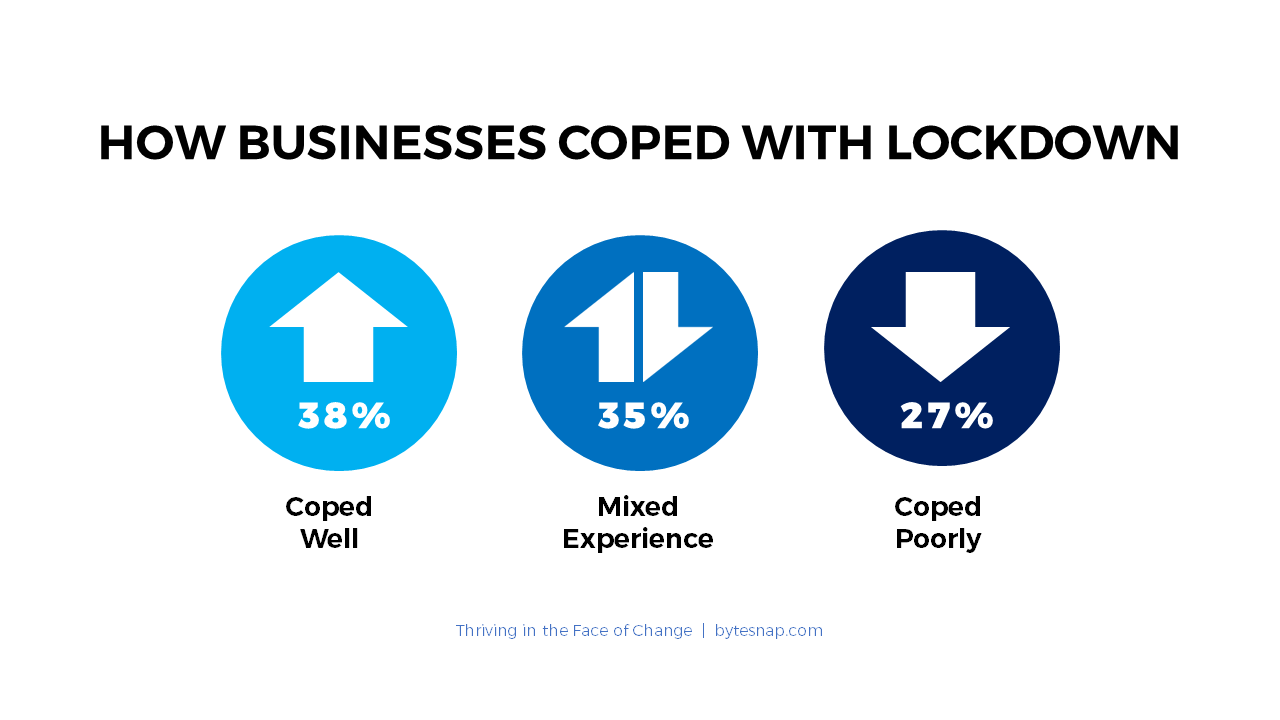

The results of the research reveal how in spite of 82% of the electronics industry being affected by supply chain challenges, positively 38% of the industry has coped well with the pandemic, while 35% have had a mixed experience.

2021 Electronics Industry Survey – Key Findings

-

- Increasing demand for products and services

Despite the pandemic, 60% of respondents saw an increase in demand for their product or services, 9% experienced no change and 31% experienced a decrease.

- Increasing demand for products and services

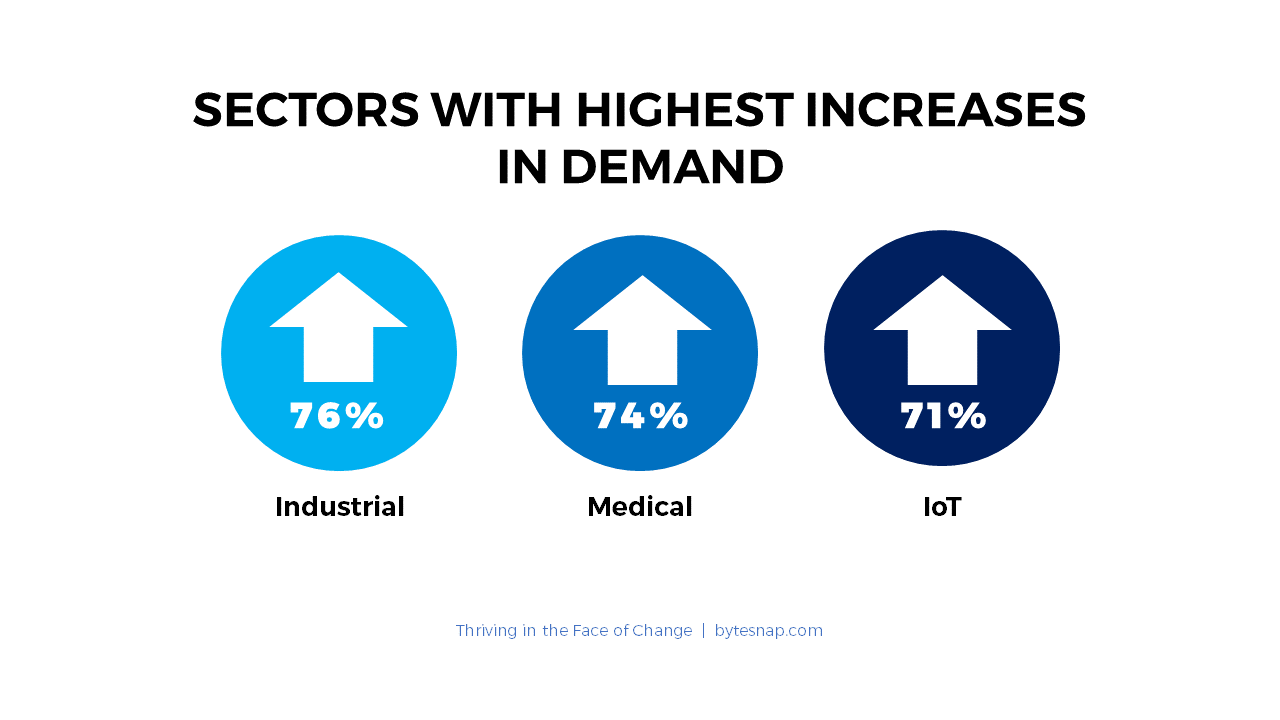

The sectors with the highest increase in demand for products and services:

Industrial 76%

Medical 74%

IoT 71%

Sectors with greatest decrease in demand for products and services:

Aerospace 27%

Automotive 25%

Consumer 16%

- Component challenges continue

There has been a great surge in demand for electronics components where more than 56% of the businesses surveyed had been affected by the wave. 34% of these respondents experienced long lead times for their required components and 24% of them were not able to procure sufficient parts and products.

- Nearly half of businesses bounced back in 12 months

45% of those surveyed saw their businesses bounce back within 12 months of the pandemic. This was against a more hopeful 86% that believed they would be back to normal within a year.

In the first three months of the pandemic, 22% did not experience any dip in sales activity, while over the year that figure decreased to 19% experiencing no dip in sales. Only 11% of businesses are yet to reach their pre-COVID sales levels.

- Concerns about supply chain disruption remain

During the first lockdown, 18% of the electronics sector was concerned about supply chain disruption.

This has translated into 45% of companies holding more stock in-house rather than just in time (JIT) and 26% now auditing their supply chains more closely.

While 10% of respondents in 2020 were considering using more domestic suppliers, the survey revealed that less than 11% actually moved part of their supply chain to the UK.

- The negative impact of Brexit

53% of the companies surveyed have felt the negative impact on their business since Brexit as 70% of them cited ordering from or moving across to Europe has become more expensive and difficult, with increased paperwork.

Just 3% of those surveyed state that they have benefited from Brexit.

As well as statistics comparing different sectors, the report also provides further insight into each question with direct quotes from respondents and comparisons from ByteSnap Design’s 2020 survey.

Graeme Wintle, Director at ByteSnap Design concludes: “As we continue to face the challenges of coronavirus, we hope that this report will be a useful insight into how far the electronics sector has come and what the electronics industry can expect to see in the future.

“At ByteSnap Design, we’ve seen a continued demand for our work on IoT, healthcare and tracking devices. We’re proud of how our team has responded to the challenges during the past year and successfully implemented a remote/office-based working set up so that we can continue to support our clients.”

Download the whitepaper for more key insights from our 2021 electronics industry survey